Remove a property Guarantee Line otherwise Unsecured Personal line of credit

Looking for to create down root while on the move from inside the retirement age? Or searching to purchase property away from Canada which you can use from time to time? To find a secondary home has long been a well-known method for the elderly to make certain he’s a place to go possibly when the much time Canadian cold weather sets in or a space which they can go to consistently with their longer household. Certainly one of several of the most popular destinations for snowbirds is actually Florida, Costa Rica, Panama, Hawaii, Mexico and you will Cuba.

Having home prices within the urban centers including Florida nonetheless sensible for many Canadians even after good 78-cent loonie demand for vacation residential property continues to be good. If you have been studying the new Toronto Superstar, you more than likely seen men and women one web page advertisements on the best way to get a house for under $two hundred,100000. So it cost, in addition to the weather and you will decreased county tax having individuals, are attracting both the elderly and you will younger people.

To purchase a holiday family, although not, is quite diverse from to find an initial household. If you find yourself to purchase off country might help better manage your self from inside the the big event out of market modification during the Canada, you still have to get the way to pay for your second domestic.

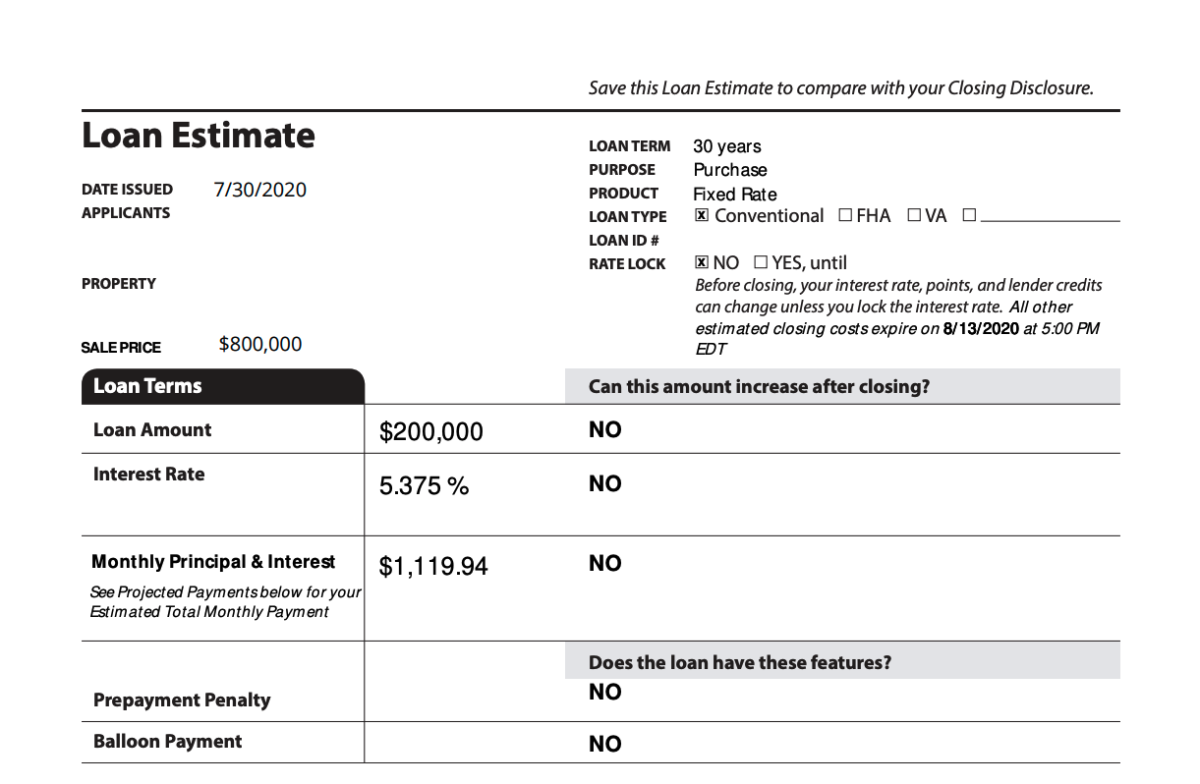

Property Collateral Line of credit or HELOC to possess short performs just as the in an identical way since the refinancing the mortgage in order to buy an income property. Customers is also already get good HELOC getting as low as step 3.20%. Whenever you are to find property in the Fl, like, this will circumvent dealing with an effective You.S. lending company. Its an identical process by taking away an enthusiastic unsecured range out-of credit something which is possible while a tenant otherwise the new homebuyer which has not yet yet built up sufficient security in your latest household. But whilst is not backed by a big asset, you’ll likely pay a top interest rate.

Handle a neighborhood Home loan company

People also have a choice of dealing with a home loan company in the united kingdom in which the trips house is discovered. Yet not, this is really pricey. Once again playing with Florida by way of example, Canadians can receive a beneficial U.S. financial but American banks often don’t count Canadian credit score.

Your best option is to try to handle an excellent Canadian financial whom has actually branches in your neighborhood in which you’d like to purchase something that’s an alternative in both the brand new U.S. and Caribbean. By the signing up for home financing that have a beneficial Canadian lender which have around the world connections, you can likely receive a much lower price.

The reason you to Canadians are unable to take out home financing on a great travel family exterior Canada by way of its local institution (if they don’t possess branches overseas) is mainly because Canadian loan providers have no court legislation outside Canada. Should installment loan Hamilton IN you be incapable of build your home loan repayments, good Canadian lender cannot do just about anything and that’s banned from repossessing our home.

Keep in mind that there is certainly certain places who do maybe not enable it to be investment whatsoever, otherwise there is certainly restrictions toward overseas property possession.

Purchase with a buddy otherwise Partner

This will be a great way to reduce the charges for the newest consumer. Find out if family, family otherwise anybody else you know is wanting to shop for a secondary house. Co-ownership function you split the costs or take transforms using the property. But not, it has got to-be some one you can rely on for the the accounts particularly when you are looking at the way they invest or save their money. It’s also a good idea to write a written contract that states exactly how duties would be separated, and you may what would be to happens if a person manager uses it more than additional or if one-party desires to sell the house or property.

Any alternative Charge ought i Look out for?

One of the largest will cost you outside your mortgage is actually taxation. Prior to beginning your quest for your fantasy family out-of home, be certain that you’re familiar with all of the travel household taxation laws and regulations which differ predicated on nation otherwise condition if it’s throughout the U.S. The individuals taxation guidelines have more tricky if you intend towards the renting out the assets if you are not using they.

Almost every other expenditures to include is actually home insurance, called for home improvements, resources, Websites, repairs can cost you and you can seats. You could need to pay a relocation business otherwise one most other service that’s an essential part of establishing your trip domestic. And also need to ensure that the house or property is safe and you can safer if it is unoccupied to attempt to end break-in or vandalism.

To order a holiday house is an expensive union, however it can also fulfill lifelong desires and become just the right means for your old age. Make sure cautious considered and you will budgeting and research thoroughly, therefore along with your friends is going to be capable appreciate they for a long time in the future.

Sorry, the comment form is closed at this time.